Healthcare's Geographic Divide: Where to Deploy Your Marketing Resources Now

Kentucky's looking at $12B in Medicaid cuts after the passage of the One Big Beautiful Bill while Texas faces different dynamics entirely. Here's how to adjust your marketing strategy.

When was the last time you approached pipeline planning in terms of Medicaid expansion status?

The One Big Beautiful Bill (OBBB) created a geographic divide where market conditions in Medicaid expansion states look very different from non-expansion states.

Last week, I broke down how the OBBB creates both a $50 billion rural health technology opportunity and the most significant healthcare market contraction since the Great Depression.

In this article, I’ll dive into where those coverage losses hit hardest and how this changes your messaging strategy and target account approach.

A Quick Caveat: Policy Stability in an Unstable Time

Everything I'm outlining here assumes the OBBB stays as written, but policy stability isn't exactly this administration's strength.

Senator Josh Hawley, R-Mo., introduced legislation to counter Medicaid cuts just 14 days after voting for the bill that created them. That should tell you something about the political pressure building.

History gives us two scenarios for how this could play out. The Medicare Catastrophic Coverage Act got completely repealed just one year after passing (even with bipartisan support) because beneficiaries mobilized against it. But the ACA survived 50+ repeal attempts because once people started using the benefits, complete reversal became politically impossible.

More likely? We'll see partial modifications rather than complete repeal, similar to how individual ACA provisions were eliminated while the core structure stayed intact.

You have to plan for today's legislative reality while also building flexibility into your strategy. Track policy discussions that could shift your planning assumptions. Build agility into your messaging frameworks so you can pivot quickly if needed.

The fundamentals of geographic market analysis still apply. You just need to stay ready to adjust as the landscape evolves.

Now, let’s get on with it…

Geographic Positioning Went From A ‘Nice To Have’ To A Critical Piece of Your Strategy

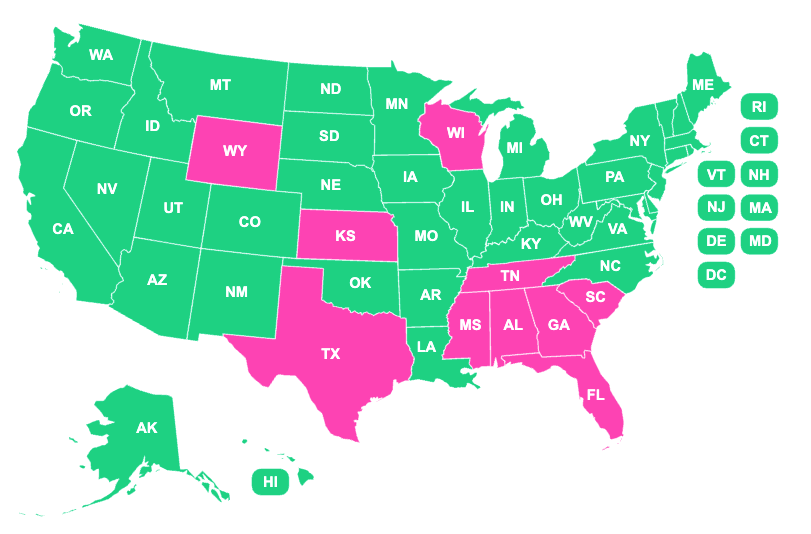

The OBBB's impact splits along a clear line: Medicaid expansion states versus non-expansion states.

The OBBB's work requirements and coverage restrictions hit Medicaid expansion populations directly. That means 41 states plus D.C. (the expansion states) are projected to see the biggest budget pressures as coverage losses translate into increased uncompensated care.

Kentucky is looking at over $12 billion in rural Medicaid cuts with North Carolina, Virginia and Illinois facing similar numbers. Meanwhile, non-expansion states like Texas and Florida, which never expanded Medicaid in the first place, face different financial dynamics.

This creates divergent market conditions that require different sales and marketing approaches.

Expansion states are in survival mode. Hospital systems in these markets are likely to prioritize cost reduction over innovation.

Non-expansion states may be more focused on growth. These markets didn't expand Medicaid coverage, so they're not facing the same coverage reductions. They may also be better positioned to compete for rural transformation funding since they're starting from a different baseline.

Mapping Your Strategic Vulnerabilities (And Opportunities)

You can’t send the same case studies to Detroit and Miami when those markets are about to respond to completely different value propositions. The key is understanding which of your target accounts are most vulnerable to coverage losses versus which ones have diversified revenue streams, then tailor your messaging accordingly.

Highly vulnerable accounts → cost-focused messaging:

Safety-net hospitals with high Medicaid patient volumes in expansion states

Rural hospitals in states that expanded Medicaid to improve their financial position

Academic medical centers with significant Medicaid-dependent programs

For these hospitals, you’ll want to lead with ROI and cost avoidance in your first touchpoint. Your content should focus on budget relief rather than technological advancement.

Example: "System X reduced operational costs by $2.3M in year one" versus "System X implemented cutting-edge AI diagnostics."

Focus on how your solution helps systems handle increased patient volumes with existing resources. Efficiency gains become the primary value proposition. Position your company as a strategic partner helping systems navigate financial challenges, not just another vendor selling technology. Emphasize how your solution reduces administrative burden and regulatory risk during a period of increased oversight.

Low-vulnerability accounts → growth-focused messaging:

Hospitals with diversified payer mixes where Medicaid represents less than 30% of revenue

Systems in non-expansion states that already operate with limited Medicaid

Specialty hospitals and outpatient facilities serving commercially insured populations

Systems with strong cash reserves and investment portfolios that provide financial buffers during market transitions

These hospital systems may have more financial flexibility for technology investments that support expansion rather than just survival. With more stable budgets, they may be more receptive to messaging about gaining competitive advantages over expansion state competitors. Your case studies should focus on features and capabilities that set systems apart in their markets. Many non-expansion states have significant rural populations and may be better positioned to compete for federal rural health transformation funding.

Once you've mapped your account vulnerability, the next question becomes: what do you do if most of your revenue sits in high-risk markets?

Diversification Strategies for Medicaid Expansion-Heavy Companies

If your customers are concentrated in expansion states, you need to reassess your account prioritization and messaging strategy. The projected coverage losses create genuine revenue risk for companies heavily dependent on these markets.

Account portfolio rebalancing and prioritization becomes a strategic priority if the majority of your targets are in expansion states. This means actively identifying high-value prospects in Texas, Florida and other non-expansion states where you've had limited presence. That needs to be reflected in marketing spend to focus on more stable geographic markets and building account research around non-expansion state health systems that may have budget flexibility for technology investments.

Pipeline forecasting should also reflect geographic risk. Deals in high-vulnerability states may have longer timelines and lower close rates, while non-expansion state opportunities may convert more predictably. This requires adjusting your sales forecasting assumptions and potentially your revenue recognition planning based on where your pipeline is concentrated geographically.

From The Blog

Your 90-Day Geographic Strategy Action Plan

Over the next quarter, here's what you should prioritize:

Audit your target account portfolio by expansion status. Calculate what percentage of your accounts are in expansion versus non-expansion states.

Segment your messaging by geographic vulnerability. Create different messaging frameworks for expansion state accounts (cost-focused) versus non-expansion state accounts (growth-focused). Your case studies, white papers and sales collateral should reflect these different value propositions.

Adjust account prioritization. Consider reweighting your target account list to include more non-expansion state prospects if you're heavily concentrated in high-risk expansion markets.

Build geographic intelligence into your account research. For each target account, understand their Medicaid revenue exposure, payer mix and financial resilience. This should inform your messaging approach and expected conversion timelines.

The window to get ahead of these changes is closing. Your competitors are reading the same projections and making the same calculations about where to focus their resources.

Need help mapping your marketing strategy against OBBB risks and opportunities? Let's talk about your specific market mix and build a strategy that accounts for these new geographic realities.

P.S. Forward this to any health tech founders or leaders who need to understand how this legislation affects their business.

About the Author

Heather Lodge, Fractional Chief Marketing Officer, The Hybrid CMO

Heather helps growing health tech and healthcare service companies transition from ‘spaghetti-against-the-wall’ marketing to scalable operations so they can go toe-to-toe against better-funded rivals. She helps establish clear market positioning, develop focused account-based marketing programs and build the systems and teams needed to scale effectively. Heather’s approach combines strategic leadership with hands-on execution, building marketing programs that drive consistent revenue growth.